Bad Credit? Get Approved For the Car Loan for a Bad Credit

Why Choose a Car Loan for a Bad Credit Score?

Searching for a car loan for a bad credit or car loans with low credit? You’re not alone. Many Canadians worry that poor credit means no financing but that’s far from true.

When you have the right lender, bad credit doesn’t stop you from getting financing:

- Rebuild your credit through consistent, on-time payments

- Give you the freedom and mobility to manage work and family life

- Be accessed through dealerships that specialize in supporting credit-challenged customers

Bad credit doesn’t mean no options. It just means the right plan.

What You Need to Know About Car Loans and Bad Credit in Canada

Getting a car loan for bad credit or car loans with low credit isn’t just possible, it’s increasingly common across Canada. Many individuals deal with credit challenges due to life changes, unexpected expenses or being new to the country. At The Car Boys, we work with you, not against you.

Credit Score Ranges and What They Mean for Car Loans

| Credit Score (Canada) | Rating | What It Means for Auto Loans |

|---|---|---|

| 760 – 900 | Excellent | Best interest rates, instant approval |

| 725 – 759 | Very Good | Competitive rates, quick approval |

| 660 – 724 | Good | Likely approval, moderate interest |

| 560 – 659 | Fair | Approval possible, higher rates |

| 300 – 559 | Poor | May need specialized lenders |

Even if you’re in the “fair” or “poor” credit range, you can still access flexible, realistic bad credit car finance options.

Key Terms You Should Know (Glossary)

- APR (Annual Percentage Rate): Total yearly cost of borrowing, including fees.

- Amortization: Gradual loan repayment over time via equal monthly installments.

- Conditional Approval: Pre-approval based on initial data, finalized after verification.

- Pre‑Approval: A lender’s initial estimate of how much you may borrow based on credit review.

Understanding these basic terms helps you talk confidently with lenders and avoid hidden surprises.

Our Approach to Bad Credit Car Finance

At The Car Boys, we focus on local support, honest advice and flexible financing making it easier for you to get behind the wheel, no matter your credit history.

Trusted Local Dealerships in Canada

We’ve partnered with bad credit car dealerships in Canada that understand how to navigate non‑prime financing. These are not just car lots, they’re credit recovery partners.

Guaranteed Approval With Realistic Expectations

While we strive to offer bad credit car loans Canada guaranteed approval, final approval always depends on a few factors: proof of income, valid ID and a realistic payment plan.

Quick Approvals & Capital Lease Options

- Instant online pre‑approval

- Approvals in less than 24 hours for most clients

- Quick approvals for capital lease with bad credit for commercial buyers or entrepreneurs

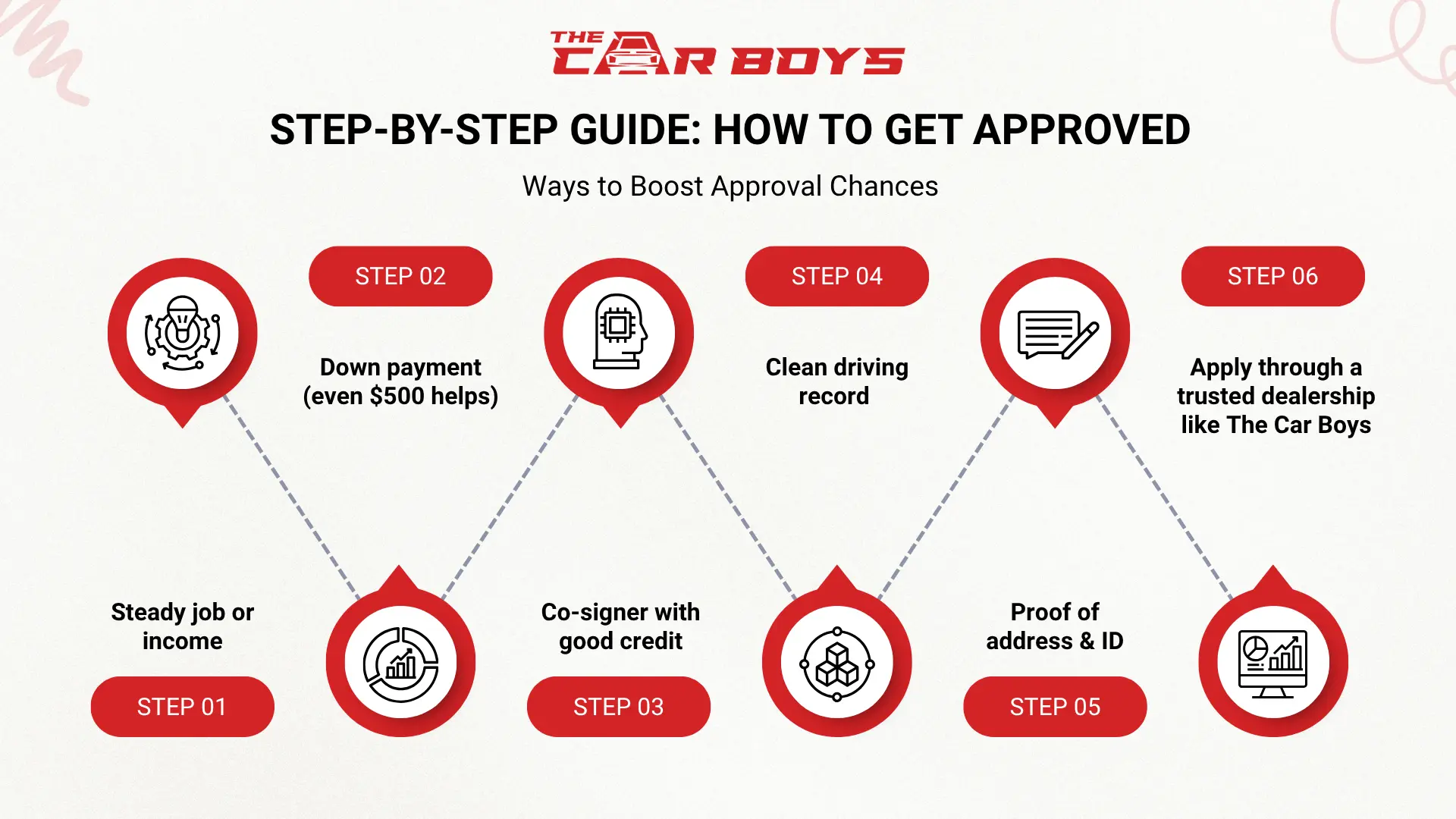

Step-by-Step Guide: How to Get Approved

1. Check Your Credit Report

Start by reviewing your credit with Equifax or TransUnion Canada. Knowing your score helps you understand your options and prepare for discussions with lenders.

2. Gather Your Documents

Have these ready to speed up the approval process:

- Government-issued photo ID

- Recent pay stubs or direct deposit slips

- Utility bills (for address verification)

- Proof of insurance and your valid driver’s licence

- Any paperwork for a vehicle you’re trading in

3. Consider a Co‑Signer

A co-signer with good credit can improve your approval odds and help you qualify for a lower interest rate. It’s a smart move if you’re new to credit or rebuilding.

4. Compare Loan Offers

Don’t settle for the first offer. Check rates from both banks and car dealerships to find the best fit for your budget and timeline.

5. Make a Down Payment

Even a small down payment like $500 to $1,000 can lower your monthly payments and show lenders you’re serious.

6. Finalize the Loan & Start Rebuilding Credit

Once approved, review the terms, sign the agreement and start making on-time payments. Within a year, you’ll likely see real improvements in your credit score.

Bank vs Dealer Financing – Which Is Better?

| Feature | Bank Loan | Dealer Financing (The Car Boys) |

|---|---|---|

| Approval Time | 2–5 days | Same-day possible |

| Minimum Credit Score | 650+ preferred | Accepts 500–620+ |

| Paperwork Required | Extensive | Minimal & guided |

| Flexibility | Lower | High |

| Suitable For | High-credit borrowers | Credit-challenged Canadians |

With car loans with bad credit Canada clients, car dealer financing provides flexibility, speed and real-world understanding of your needs.

Can a Car Loan Improve Your Credit Score? Absolutely.

Financing a car is one of the most effective ways to build or rebuild your credit Score when managed responsibly.

- Every on-time payment adds a positive mark to your credit report

- Boosts your payment history, which makes up 35% of your credit score

- Adds variety to your credit mix by including an installment loan

- Refinancing later can lead to better rates once your credit improves

Stick to your payments and your credit will thank you.

No Credit or New to Canada? Here’s How to Get Approved

Just starting out with credit or recently moved to Canada? You can still qualify for a car loan. Here’s how:

- Show alternate proof of income or stability – use bank statements, rent receipts or CRA tax documents

- Build early credit – set up a secured credit card or put utility bills in your name

- Make a larger down payment – contributing 15–20% upfront improves your approval chances

- Work with the right lenders – seek out specialists in credit-challenged auto loans who understand your situation

You don’t need years of credit history – just the right guidance.

Used Cars for Sale with Bad Credit

At The Car Boys, we connect you to a wide selection of certified used vehicles that are both reliable and budget-friendly. Perfect for those navigating credit challenges, our inventory includes:

- Bad credit car loans in Ontario and surrounding areas

- Local used car dealerships that understand your credit needs

- Used cars under $20,000 with flexible financing options

- Vehicles that come with safety certification and warranty for peace of mind

Affordable, approved and ready to drive – right here in Canada.

Conclusion: Your Road to Approval Starts Here

At The Car Boys, we don’t judge; we help. Whether you’re working with bad credit car loans in Canada, exploring car loans with low credit or just starting your credit journey, we walk with you each step of the way.

Apply online or visit our Mississauga dealership today. Friendly advisors. Great inventory. Transparent terms. Your next car and your credit comeback are waiting. Let’s drive forward.

FAQs – Car Loans for Bad Credit in Canada

1. Can I buy a car with bad credit in Canada?

Yes, you can buy a car with bad credit. At The Car Boys, we help people across Canada get approved for car loans with low credit even with past issues. We work with lenders who focus on your current situation, not just your credit score.

2. How much credit score is needed for a car loan in Canada?

Most lenders prefer a score of 660+, but you can still get approved with a score around 500–600, especially if you have steady income and a small down payment.

3. Can I pay my car loan with a credit card?

Not directly. Most lenders don’t accept credit card payments for car loans. Instead, payments are made through your bank account or by pre-authorized debit.

4. What if I have no credit history?

No problem. You can still get a loan by using alternate proof like rent receipts, bank deposits or by applying with a co‑signer. We also recommend starting with a secured credit card to build your credit from scratch.

5. How fast can I get pre-approved?

Most of our clients get quick approvals within 24 hours. Just fill out a simple application online or visit our location in Mississauga.

6. How to build credit when no one will approve you?

Start small. Open a secured credit card, pay your cell phone and utility bills on time and consider getting a co‑signed loan. At The Car Boys, we also offer options that help build your credit even if you’ve been denied elsewhere.

7. What credit score do you need for a $30,000 car loan in Canada?

To qualify for a $30,000 car loan, most lenders prefer a score of 620 or higher. But even with a lower score, you may still qualify with a strong income or a co-signer. We help you explore all available options.

Recent Blogs

Why These 15 Canadian Car Companies Stand Out

Why These 15 Canadian Car Companies Stand OutMany buyers ask a simple question before choosing a vehicle: Does Canada make cars or are they only imported? The answer is clear. Cars made in Canada play a major role in the North American auto market. While Canada may...

Can You Buy a Car with a G2 Licence?

Can You Buy a Car with a G2 Licence?If you are a new driver in Mississauga, this question usually comes up right away. Can you buy a car with a G2 licence or do you need to wait until you get your full licence? Some people say yes. Others say no. Add insurance costs...

12 Best Selling Cars in Canada 2026

12 Best Selling Cars in Canada 2026Canadian drivers want cars that feel practical, good on fuel and safe in winter. The year 2026 follows the same pattern. SUVs (sports utility vehicles) stay steady. Sedans and EVs (electric vehicles) still have a loyal group of...